Thanks to Dave Ramsey’s Endorsed Local Provider program for sponsoring this post!

We climbed out of $20,000 credit card debt.

NOT EVEN JOKING.

And BUDGET is still one of the words I hate most in the English language.

Especially with the holidays right around the corner.

The word makes me cringe. But it got us to where we are today.

CREDIT CARD DEBT FREE.

If you’ll recall about 3 months ago I shared with you guys how we paid off over $20,000 in credit card debt. Well today I thought I would share some additional details of how we climbed out of that massive debt and to answer some questions from the original post.

![]()

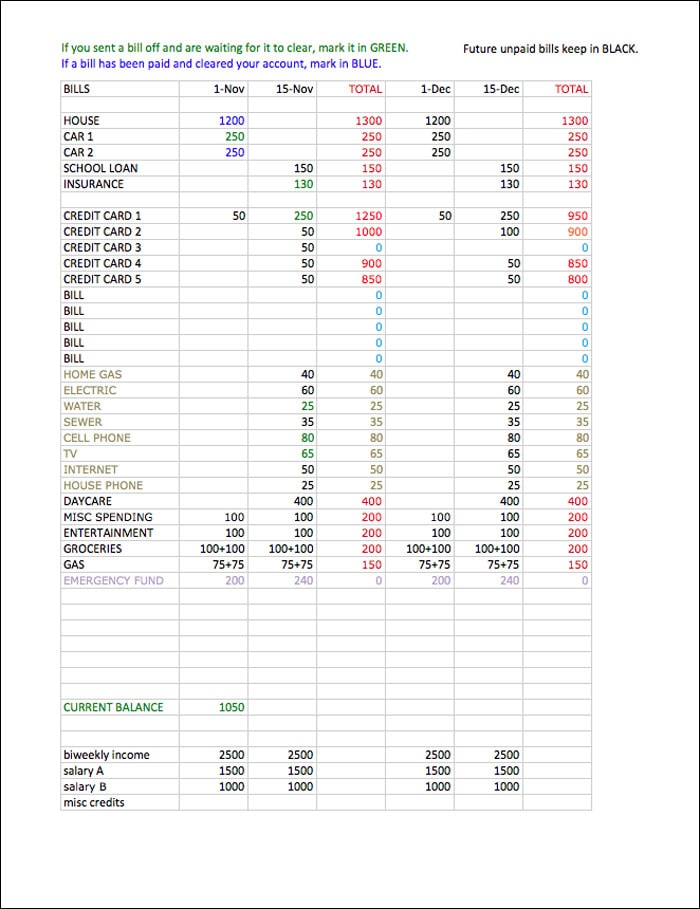

I created a monthly budget expense sheet in Microsoft Excel (I’ve had the same one since 2008). As I said before, I’m kind of obsessed with budgeting. Looking online at my daily credit card and checking account balances helps me keep my budget spread sheet up to date (I like to color code things to know what charges are pending and what has cleared). You can get a free copy of it here.

![]()

The hardest part was trying to figure out how much extra money we needed each month (unexpected birthday parties, car maintenance, clothing, home and lawn updates, etc.). This took a lot of trial and error. I tried to give myself enough “extra” cash in our account to cover our two weeks in between paychecks, but the first couple of months I kept running out and had to put some expenses on credit cards. BAD IDEA. The money I had just paid off went right back on.

So then I started giving myself a little padding every two weeks. BUT I still kept it to the side in an “emergency fund”. If I didn’t need the funds at the end of the two weeks, I put it towards a bill. If I did need the emergency fund in that time period, I went back and really analyzed why I needed to use it (did I buy something I really needed? did I forget about an expense like Girl Scout registration?).

We wrote down every single expense that we could possibly track each month: mortgage, car payments, school loans, utility bills, cell phone, internet, groceries, entertainment, etc. Every dollar counted. We were living paycheck to paycheck, but in the best way possible…paying off debt with every last penny.

![]() A lot of people read my original post and thought we paid off the debt super quick. Uhh… no. It took us 6 years to pay off the $20,000 in credit card debt. We don’t make a crazy amount of money each year. We are REAL people! But I promise you if you stick to a plan, you can achieve your goal! And it’s totally worth it in the end.

A lot of people read my original post and thought we paid off the debt super quick. Uhh… no. It took us 6 years to pay off the $20,000 in credit card debt. We don’t make a crazy amount of money each year. We are REAL people! But I promise you if you stick to a plan, you can achieve your goal! And it’s totally worth it in the end.

We didn’t live like paupers for 6 years. We didn’t sit at home depressed for 6 years. We just cut back when and where needed and reminded ourselves of that end goal… financial freedom.

![]()

Nope, which is why I had that little emergency fund in my budget worksheet. Remember I also planned out 3 months at a time so we wouldn’t have any surprises in our budget. But with the emergency fund I could easily allocate money towards back to school shopping or Fall clothes if needed without having to put money on credit cards.

![]()

It’s quite a difficult task to cut spending completely when you’re trying to pay off debt. There are some things you really still need to buy, like clothes for your kids. Just remember that the faster you pay off the debt, the faster you can get back to normal life. Yes, it is going to be difficult for awhile. Life is gonna suck. I’m not going to sugar coat it for you. But you will be so much happier in the end if you realize early on what is a NEED and what is a WANT.

Needs are things we needed to get by month to month: food, gas, and paying our monthly bills. Even clothes weren’t a necessity unless we were in dire straits, like Ellie not having one thing that fit her this Fall since she grew like 6 inches in the past year.

![]()

I put a sticky note on each one of my credit cards in my wallet to remind me to curb my spendings.

“Do you really need that?”

“You could be debt free dummy!”

“Nothing tastes as good as debt free feels… or something like that.”

Trust me, the embarrassment of explaining one of those sticky notes to a cashier once or twice will make you rethink your spending habits.

![]()

Of course we did! We would go out to eat every so often, but not go crazy. Luckily my husband and I would rather have a date night at home with Chinese food and Netflix rather than going out to dinner and a movie. Of course I spent money on DIY projects, but it was a lot cheaper than hiring out! My backsplash only cost us $250 and our outdoor dining table we built for under $100!

![]() Set a goal and JUST DO IT ALREADY! Don’t wait until tomorrow. Stick to your budget spreadsheet. Work on paying off just one credit card at a time.

Set a goal and JUST DO IT ALREADY! Don’t wait until tomorrow. Stick to your budget spreadsheet. Work on paying off just one credit card at a time.

![]()

If you want to live the debt free and get on the money saving path like us, you can check out Dave Ramsey’s snowball plan. It helped us pay off our credit cards, yes… all $20,000. You can also check out Dave Ramsey’s Endorsed Local Provider program for help finding the right recommendation for investing, real estate, insurance, health insurance and tax services.

REMEMBER, YOU CAN DO THIS.

Need more help?

Check out my 25 Ways to Save Money tips.

This post was sponsored by Dave Ramsey’s Endorsed Local Provider program but all opinions are my own!

This post was sponsored by Dave Ramsey’s Endorsed Local Provider program but all opinions are my own!

Jennifer says

I read this tip somewhere and it has worked for me: when you want to buy something you don’t really need, imagine someone offering you the item OR the cash it costs. Which do you want more? So far it has really worked with impulse purchases when I am out.

howtonestforless says

SUPER smart!!!

Suezzte Creger says

very helpful.

Chrissi says

LOVE THIS!!! It’s just what I need 🙂

chrystal smallwood says

Thanks for these articles. I just came across them via Pinterest. They truly are the most realistic, real-people on a real-salary articles I’ve read on getting out of debt. Thank you!

howtonestforless says

Thanks! Glad it was helpful!!

Dorothy Lopez says

I have a 1st and 2nd mortgage on my house. I can’t refinance my home because I made a mistake in purchasing a auto for somebody else that was repossessed and I am now stuck with the judgement debt for 20 yrs. Anyway. I have been paying extra against my 2nd mortgage that has a fixed interest rate. I started paying an extra $6.21 against the principle every month and over the course of time I started seeing a zero balance due every month. The payment was $143.79 and I just started paying $150.00 a month. Needless to say I am paying this off early. I also started putting an extra $11.00 a month against my principle on the 1st mortgage. Its not much but its an extra $132,00 a year against the principle and less interest I own mortgage company.

Diane taber says

Hi we’ve just been trying to get out of this debt.and need to sort this now.as unless we do it’s never going to go away.and I have said this to my husband time and time again.but need a fast sure way to fix it.or a way to fix this.and would like a few hints and tips.from people who’s actually done this. And have actually got out of the debt complete.